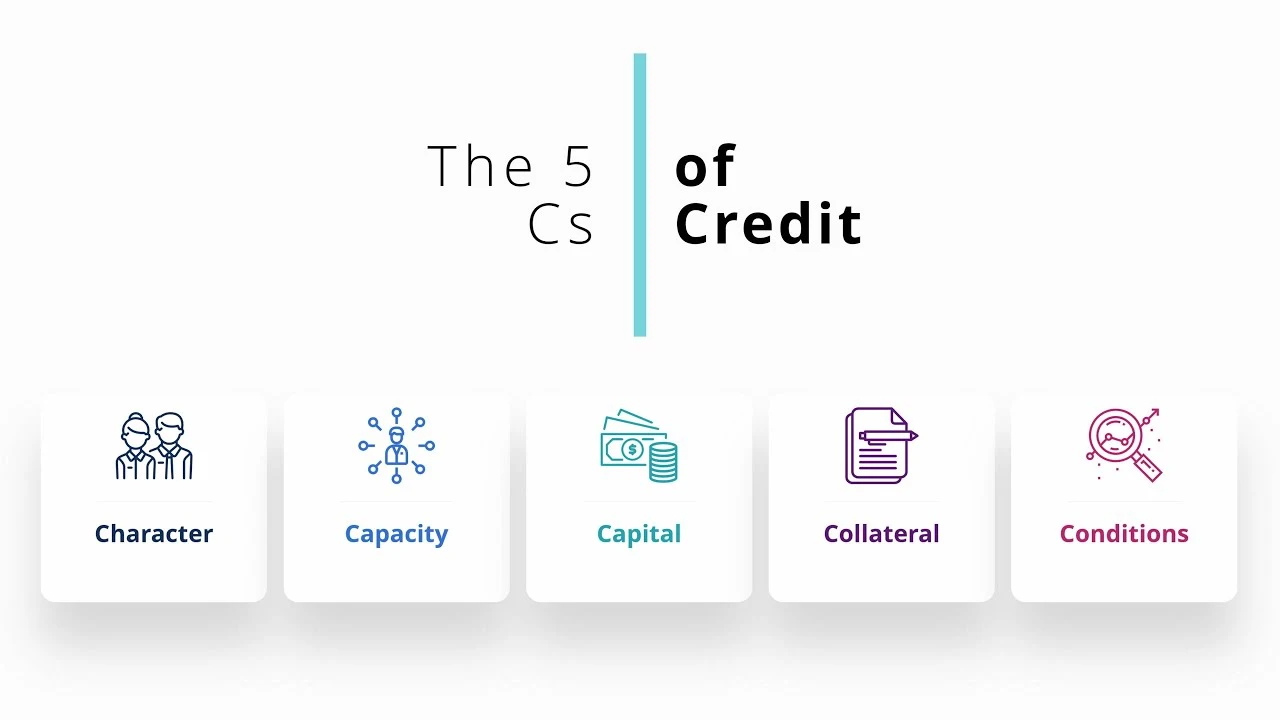

What do the lenders look for to determine if they are comfortable to lend to a borrower?

The team at Trusted Finance Solutions have a credit background with direct banking experience and we feel that this sets us apart from our competitors in assisting you obtain finance with the least amount of hassles.

Character

In addition to credit reporting and credit scoring and determining if you have been paying bills and making repayments on time, the banks look at many other factors in your character to determine credit worthiness. For example, they will review the stability and length of employment and how long you have been at a set address for.

Capital

Capital refers to your net worth which is the total value of your assets less liabilities. This is also called your net asset position. It is assumed that a first home buyer will have a rather low net asset position. However, an older applicant will need to explain in more detail why s/he has a low asset position for example.

Collateral

Collateral is the security that you will be providing for the loan, such as a property that is about to be purchased. This collateral or security will be sold by the lender in the event that the borrower defaults on the loan, to clear the debt. Some lenders may require a guarantee in addition to collateral. A guarantee means that another person also signs the loan agreement and promises to repay the loan if you can’t.

Capacity

Capacity is effectively your ability to repay the new loan you are seeking, after factoring in your income as well as your existing loans and living expenses. Some call this your debt to income ratio but each lender has a different name and different calculation. Regardless, the greater surplus you have after all expenses, the stronger the finance application looks and the higher the probability of approval.

Conditions

Lenders consider a number of other factors that may affect your financial situation such as the industry you are working in and how a slowdown in that industry may impact your ability to make repayments. Lenders will also look at what the purpose of funds are for and how that fits in with their policy.