Engineers in Australia often have access to home loan benefits, including waived Lenders Mortgage Insurance (LMI), lower interest rates, and higher borrowing capacity. Their stable income and strong career prospects make them low-risk borrowers in the eyes of many lenders, which can open doors to more favourable mortgage options.

Whether you're buying your first home, investing, or refinancing, understanding how to make the most of these benefits can help you secure a better loan deal. At Trusted Finance Solutions, we’re here to simplify the process and help you find a home loan that fits your financial goals.

Let’s take a closer look at how you can leverage your profession to access better home loan opportunities.

How Being an Engineer Can Help You Get a Better Home Loan

As an engineer, you are trained to solve complex problems, think critically, and plan with precision. These skills can also work in your favour when securing a home loan. Lenders often view engineers as financially stable professionals because of their consistent employment and strong earning potential, which can help improve mortgage approval chances and lead to more favourable lending terms.

Whether you work in civil, mechanical, software, or electrical engineering, your career is built on stability and progression, which are key factors lenders consider. This can open up opportunities for greater borrowing power, flexible loan options, and competitive mortgage deals. Knowing how lenders assess engineers can help you approach your home loan with confidence and take full advantage of your professional standing.

Potential Home Loan Benefits for Engineers

Some lenders offer exclusive home loan benefits for engineers, which can help reduce costs and improve loan terms. While these options aren't available from all lenders, understanding them can help you make better decisions.

1. LMI Waiver for Engineers

Some lenders offer a 90% LVR no LMI option for eligible engineers, allowing them to borrow up to 90% of a property's value without paying Lenders Mortgage Insurance. This can lead to more savings, especially in cities like Sydney, Melbourne, and Brisbane. For engineers with a limited deposit, this waiver helps reduce upfront expenses and makes homeownership more accessible.

2. Competitive Interest Rates

Some Australian lenders may offer discounted interest rates for engineers, which could help lower monthly repayments and reduce total loan costs over time. Accessing a lower interest rate can significantly reduce long-term repayment costs, making homeownership more affordable over time.

3. Higher Borrowing Power and LVR for Engineers

Some lenders assess engineers as low-risk borrowers, which could allow them to borrow up to six times their salary and access a higher Loan-to-Value Ratio (LVR), depending on lender criteria. Some lenders offer up to 95% LVR, meaning engineers could secure a home loan with just a 5% deposit. This can be beneficial for first-home buyers or those looking to enter the market sooner.

4. Tailored Home Loan Options for Engineers

Many lenders offer home loan options designed to suit the financial goals and career paths of engineers. With stable incomes and strong earning potential, engineers can benefit from loan structures that provide flexibility, stability, and potential savings.

Types of home loans available to engineers include:

- Owner-Occupier Home Loans – For engineers buying a primary residence.

- Investment Loans – For those looking to build long-term wealth through property investment.

- Fixed vs. Variable Rate Loans – Fixed rates offer stability, while variable rates provide flexibility.

- Offset Accounts & Redraw Facilities – These are useful features that could help engineers manage cash flow and reduce interest costs.

With the right home loan strategy, engineers can maximise their borrowing power while maintaining financial flexibility. Understanding these benefits and working with a mortgage professional can help engineers secure a loan that fits their long-term plans.

Engineers can unlock great home loan benefits. Contact our Mortgage Brokers in Melbourne today to explore your options!

How Engineers Can Qualify for an LMI Waiver

An LMI waiver may allow eligible engineers to buy a home with a 10% deposit and no Lenders Mortgage Insurance (LMI), which could lead to significant upfront savings. However, not all lenders offer this benefit, and eligibility depends on specific criteria.

To qualify, engineers generally need to:

- Work in a recognised engineering field, such as civil, mechanical, electrical, or software engineering.

- Earn above a minimum income threshold, which varies by lender.

- Hold membership with a professional association.

Since lender policies differ, not all banks provide LMI waivers for engineers. A mortgage broker for engineers can help identify which lenders offer this exemption, ensuring engineers secure the best home loan options available.

Reach out today to see if you qualify for an LMI waiver!

Which Lenders Offer LMI Waivers for Engineers?

Several Australian lenders, including major banks like Commonwealth Bank, Westpac, ANZ, and NAB, offer LMI waivers for eligible engineers. Some non-bank lenders and specialist institutions also provide this benefit. However, eligibility criteria vary. Some lenders require a minimum income threshold, while others only offer waivers to engineers with professional accreditation or in specific fields.

As lending policies change over time, the availability of 90 per cent LVR no LMI home loans depends on individual lender requirements and market conditions. Reviewing lender criteria is essential for engineers looking to access this option.

Eligibility Criteria for Engineers Applying for a Home Loan

Lenders generally view engineers as financially stable borrowers, but approval still depends on employment type, professional memberships, and financial health. Meeting these criteria can improve the chances of securing a competitive home loan.

1. Employment Type Considerations

Lenders typically favour full-time employed engineers, but contract and self-employed engineers can also qualify if they meet certain requirements.

- Full-time Engineers – Generally have no issues meeting lending criteria.

- Contract Engineers – May need to show evidence of long-term contracts or stable income history.

- Self-Employed Engineers – Usually require at least two years of tax returns to demonstrate income stability.

2. Professional Memberships and Their Impact

Being a member of a recognised engineering association can strengthen a home loan application. Some lenders require membership in organisations like:

- Engineers Australia

- Professionals Australia

- Institute of Public Works Engineering Australasia (IPWEA)

Membership can improve eligibility for waived LMI, higher borrowing capacity, or specialised loan products. Even if not mandatory, it can demonstrate professional credibility and financial reliability to lenders.

3. Financial Requirements

Lenders assess an applicant’s overall financial position to determine home loan eligibility. Key factors include:

- Credit Score – A strong credit history may increase approval chances and provide access to lower interest rates.

- Savings and Deposit Size – A higher deposit (e.g., 20% or more) can improve loan terms, but some engineers may qualify for high LVR loans with a lower deposit.

- Existing Debts – Clearing personal loans, credit card balances, or other liabilities before applying may boost borrowing power and improve affordability assessments.

Which Engineering Professionals Are Eligible?

Many lenders offer home loan benefits for engineers, but eligibility often depends on their field and professional standing. Some lenders consider factors like industry demand, job stability, and income potential, with the following disciplines commonly recognised for waived LMI and higher borrowing power:

- Civil Engineers – Working in infrastructure, construction, or urban development.

- Mechanical Engineers – Specialising in machinery, automotive, and industrial projects.

- Electrical Engineers – Involved in power systems, telecommunications, and automation.

- Software and IT Engineers – Working in software development, cybersecurity, or data engineering.

- Structural Engineers – Designing and assessing buildings, bridges, and other structures.

- Chemical and Environmental Engineers – Focused on industrial processes, sustainability, and resource management.

- Aerospace Engineers – Specialising in aviation and space technology.

Not sure if your field qualifies? Speak with our mortgage broker today to find out which lenders recognise your profession and what benefits may be available to you.

What Documents Do Engineers Need for a Home Loan?

The documents needed for a home loan vary by lender, but engineers generally need to provide proof of identity, income, savings, and financial stability. Commonly required documents include:

- Proof of Identity – Passport or driver’s license.

- Income Verification – Recent payslips, tax returns, and an employment letter.

- Bank Statements – Last three to six months of transaction history.

- Credit Report – Used by lenders to assess borrowing reliability.

- Proof of Deposit – Evidence of savings, gifted funds, or government grants.

- Existing Debt Details – Statements for personal loans, credit cards, and other liabilities.

For self-employed engineers, additional documents such as business financials, BAS statements, and two years of tax returns may be required. Some lenders may also request professional accreditation for those applying for LMI waivers or specialised home loan benefits.

How Much Deposit Do Engineers Need for a Home Loan?

The deposit required for a home loan depends on the lender and loan type. Engineers may qualify for low-deposit options, with some lenders accepting as little as 5% deposit with Lenders Mortgage Insurance (LMI) or 10% deposit with an LMI waiver.

For those who do not qualify for an LMI waiver, a 20% deposit is generally required to avoid LMI fees. Some government initiatives, such as the First Home Guarantee, allow eligible first-home buyers to secure a loan with a 5% deposit without LMI.

How Much Can Engineers Borrow?

An engineer’s borrowing capacity depends on income, employment stability, credit history, and deposit size. Those with steady employment and a strong credit score may qualify for higher loan amounts and better terms. A lower debt-to-income ratio can also improve borrowing potential.

Deposit size plays a key role. Engineers who meet the criteria for an LMI waiver may be able to secure a home loan with a 10% deposit while avoiding the expense of Lenders Mortgage Insurance. For example, an engineer earning 120,000 dollars per year could borrow between 600,000 and 720,000 dollars, depending on lender criteria and financial circumstances.

How to Secure the Best Home Loan for Engineer

By taking a calculated approach, engineers may increase their likelihood of securing a competitive home loan. Here are three key steps to consider:

1. Work with a Mortgage Broker

A mortgage broker familiar with home loans for engineers can help identify lenders offering waived LMI, competitive interest rates, and better loan terms. They can also help in comparing loan products and guiding engineers through the application process. This is particularly useful for self-employed or contract engineers, who may need additional support in meeting lender requirements.

2. Compare Lenders & Loan Products

Since lenders assess engineers differently, comparing options is essential for finding the most suitable home loan. Interest rates, fees, and lending criteria can differ, affecting overall costs and borrowing power. Some Australian lenders may offer more favourable terms for engineers, making it important to explore multiple options before making a decision.

3. Strengthen Your Loan Application

A well-prepared loan application can improve approval chances and lead to more favourable mortgage terms. Reducing existing debt can improve borrowing capacity, while saving for a larger deposit may lead to lower interest rates and potential LMI exemptions. Maintaining stable employment further reassures lenders of financial reliability, making the approval process smoother.

Taking these steps can help engineers secure a loan that aligns with their financial goals, whether buying, investing, or refinancing.

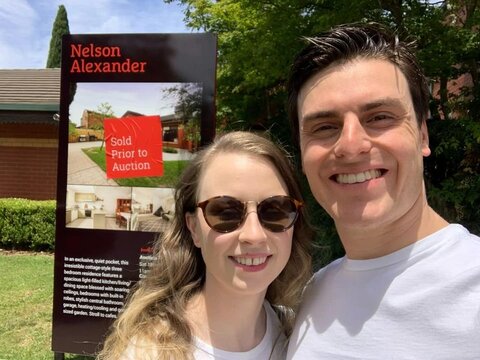

Build a Secure Future with a Mortgage That Fits Your Needs

As an engineer, you know that a strong foundation is essential for any successful project, and the same applies when securing a home loan. Choosing the right mortgage can affect your financial future, affecting affordability, repayment flexibility, and overall cost.

With potential benefits such as waived LMI, competitive rates, and higher borrowing power, engineers may be eligible for home loan options that could provide a strong financial foundation for homeownership or investment.

Trusted Finance Solutions, your premier mortgage broker in Moonee Ponds, takes a structured and calculated approach to home loans, just as engineers do in their work. We help you find the right lender, compare loan options, and structure a mortgage that aligns with your financial goals. Whether you are buying your first home, investing, or refinancing, we ensure every detail is carefully planned for the best possible outcome.

Let us lay the groundwork for your home loan. Reach out today and get started.

Frequently Asked Questions (FAQs)

Not all engineers qualify for an LMI waiver. Lenders have specific eligibility criteria, which may include working in a recognised engineering field, meeting a minimum income threshold, and holding professional accreditation. LMI waivers are typically available for full-time engineers, but policies vary between lenders, so it is important to check individual requirements.

Self-employed engineers may still access home loan benefits, but the application process is different. Instead of payslips, lenders usually require two years of tax returns, business financials, and BAS statements to verify income stability. Some lenders may offer LMI waivers and competitive rates to self-employed engineers, but eligibility depends on financial history and lender policies.

Being a member of a recognised engineering association, such as Engineers Australia or Professionals Australia, can improve eligibility for LMI waivers and specialised loan products. Some lenders require professional membership as proof of career stability and financial reliability before offering home loan benefits.

Yes, some lenders may consider bonuses, overtime, and allowances when calculating an engineer’s income, but how much is counted depends on the lender. In most cases, lenders will assess consistency and frequency, so if bonus or overtime income is regular, it may increase borrowing capacity.

Yes, Australian engineers working overseas can apply for a home loan, but lenders have stricter requirements for foreign income verification. Factors like currency type, tax obligations, and employment stability play a role in determining eligibility. Some lenders may apply different income assessment rules, so it is important to check lender-specific policies.

The Mortgage Expertise You Deserve, Delivered with a Personal Touch

At Trusted Finance Solutions, we offer a premium mortgage brokerage service that takes the stress out of securing finance. We handle everything from start to finish, ensuring a seamless experience with expert guidance at every step. With access to over 40 lenders, our award-winning brokers secure competitive rates and structured loans, so you can focus on what matters while we take care of the rest.

Speak to a Senior Finance Broker

We’re excited to assist you in securing the perfect loan. New clients can conveniently apply online anytime, while existing clients are encouraged to call us for personalised support and expedited processing.

Personalised Mortgage Solutions

Every client has unique financial goals, and we take the time to understand your situation to find the best mortgage solution for you. Whether you're a first home buyer, an investor, or looking to refinance, we provide expert advice tailored to your needs. Our commitment is to guide you through every step, ensuring a smooth and stress-free journey to home ownership.

✔️ Expertise That Matters: Our team comprises seasoned mortgage brokers in Melbourne who have a deep understanding of the ever-changing finance industry. We stay up-to-date with the latest market trends and lending practices, ensuring you receive the most current and relevant advice.

✔️ Unbiased Guidance: As independent mortgage brokers, our loyalty lies with you, the client. We are not affiliated with any specific lender, which means our recommendations are unbiased and solely focused on what suits your needs.

✔️ Seamless Process: Navigating the world of mortgages and finance can be complex, but we make it easy for you. From the initial consultation to the final settlement, we guide you through each step, clarifying any queries you might have along the way.

✔️ Extensive Network: With years of experience as finance brokers in Melbourne, we have built strong relationships with lenders, banks, and financial institutions. This network allows us to negotiate competitive rates and terms on your behalf.

Meet Our Senior Finance Brokers & Administrators

Daryn Heffernan

Mortgage Broker, Finance Strategist

Meet Daryn

Ian Smith

Finance Specialist

Meet Ian Smith

Sian Cutter

Finance Specialist & Office Manager

Meet Sian

Kartika Heffernan

Director

Meet Kartika

Richard Katan

Business Development Manager

Meet Richard

Ellana Berslaes

Broker Assistant

Meet Ellana

Kimberly Miles

Client Service Specialist

Meet Kimberly

Tracey Dean

Post Settlement Client Manager

Meet TraceyGet to Know more about us

Office Hours

- Monday 8:30 AM - 5:00 PM

- Tuesday 8:30 AM - 5:00 PM

- Wednesday 8:30 AM - 5:00 PM

- Thursday 8:30 AM - 5:00 PM

- Friday 8:30 AM - 5:00 PM

Professional Home Loans

Investment Property Loan

Leverage your current financial position to expand your investment portfolio and achieve greater financial security.

Why Use Our Brokers Instead of Going Directly to Your Bank?

Choose Trusted Finance Solutions to receive a tailored loan that aligns perfectly with your current and future financial goals, thanks to our personalised assessment and expertise. Unlike banks, we prioritise your financial well-being and navigate the complexities to ensure you get the best deal available.

- Thorough Assessment: We thoroughly assess your situation to provide a comprehensive lending solution.

- Future Consideration: Our brokers consider both your current needs and future goals.

- Best Possible Loan: We ensure you receive the best possible loan tailored to your unique requirements.

- Personal Representation: Brokers work on your behalf to arrange a home loan through a bank or lender.

- Policy Navigation: They navigate the different policies and loan requirements of Australian banks and lenders.

- Tailored Solutions: Brokers find the loan that best fits your individual situation.

Applying directly to a lender:

Quantity Over Quality: Many banks prioritise meeting quotas over your financial future.

Limited Options: Lenders can only offer a limited range of loan products.

Complex Policies: The complexity of mortgage applications means even bank staff may not fully understand their own policies, leading to delays or unnecessary declines.

Why Us

Award-Winning Mortgage Brokers

Recognised among Australia’s top mortgage brokers, earning multiple industry awards.

25+ Years of Experience

With decades of industry expertise and a keen eye for smart investments, our founder is dedicated to finding the best financial solutions tailored to your needs.

Clear & Client-Focused Solutions

Complimentary Consultation: Gain expert advice with zero commitment.

Strategic Mortgage Planning: Crafted to fit your financial ambitions.

Seamless Support: We oversee the entire process, from application to settlement.

Smarter Loans, Better Homes

Whether you're a first-home buyer, property investor, or a professional in need of specialised financing, we simplify the journey and secure market-leading rates.

Sydney’s Most Trusted Mortgage Specialists

With over 320 five-star client reviews, our Sydney-based team delivers personalised, one-on-one mortgage guidance at every step of your journey.

Accredited & Respected in the Industry

Endorsed by MFAA & FBAA, our certifications reflect our commitment to integrity, expertise, and excellence in mortgage services.

Fully Licensed & Compliance Assured

We expertly navigate complex lending requirements, ensuring a smooth and compliant financing experience aligned with all regulations.

Take the First Step – Speak to an Expert Broker

Call Now: 03 8371 0027 for a no-obligation consultation and start securing the best mortgage solution for your needs.

Tailored Financial Strategies for Every Goal

Our expert guidance is customised to suit your financial objectives—whether you're purchasing your first home, growing an investment portfolio, or refinancing for better terms.

Banks vs. Trusted Finance Solutions – The Smarter Choice

See how Trusted Finance Solutions outperforms traditional banks with personalised service, diverse lending options, and a commitment to putting clients first.

Traditional Banks

Customers are treated as just another number in the system.

Trusted Finance Solutions

Clients receive personalised service with tailored financial solutions.

Limited loan options with rigid policies.

Access to 40+ lenders with a variety of flexible mortgage solutions.

Slow approval times with complicated processes.

Fast-tracked applications with hands-on guidance.

Focus on maximising profits for the bank.

We prioritise your financial goals and best interests.

Generic mortgage plans that lack flexibility.

Custom-built strategies designed for your unique financial situation.

Call centers with minimal personal engagement.

A dedicated broker guiding you every step of the way.

Mortgage & Finance Calculators

Use our easy-to-use calculators to plan your financial future.

First Home

Second Home

Refinancing

Investment

Got a question or ready to apply?

Ready to take the first steps towards owning your dream home as a first-time buyer? Trusted Finance Solutions is here to make your homeownership aspirations a reality.

Connect with us today to schedule a consultation, and let’s embark on this exciting journey together.